Build Your Wealth with

Multifamily Real Estate Investing

All in One Proven, Powerful Online Program!

Master insider techniques to confidently invest in apartments,

mobile home parks, and self-storage properties—

and start building passive income with expert guidance at every step.

WHY THIS IS ESSENTIAL FOR ACHIEVING REAL PROFITS IN COMMERCIAL REAL ESTATE

How to find the BEST markets to execute your passive cash flow for life system

How to find the BEST markets to execute your passive cash flow for life system

How to build an A-list power team to back you up and help you maximize your time, revenue, and results

My COMPLETE Buy BIG or Buy SMALL Apartment Method that took over 11 years in the trenches to master

How to analyze any deal in 15 minutes or less with my SNIFF TEST method

Why mobile home parks are one of the BEST investments in all of commercial real estate, and how to discover a park worth investing in

How to NEGOTIATE any passive cash flow deal like a NINJA warrior

How to raise all the private money you'll ever need to fund your passive cash flow for life empire, using my secret NA strategy

My COMPLETE Buy BIG or Buy SMALL Apartment Method that took over 11 years in the trenches to master

How to systematize your business and turn it into a well-oiled machine, so you only work 15 hours a week or less, and still make a fortune in real estate

WHY THIS IS ESSENTIAL FOR ACHIEVING REAL PROFITS IN COMMERCIAL REAL ESTATE

✅ How to find the BEST markets to execute your passive cash flow for life system

✅ How to find the BEST markets to execute your passive cash flow for life system

✅ How to build an A-list power team to back you up and help you maximize your time, revenue, and results

✅ My COMPLETE Buy BIG or Buy SMALL Apartment Method that took over 11 years in the trenches to master

✅ How to analyze any deal in 15 minutes or less with my SNIFF TEST method

✅ Why mobile home parks are one of the BEST investments in all of commercial real estate, and how to discover a park worth investing in

✅ How to NEGOTIATE any passive cash flow deal like a NINJA warrior

✅ How to raise all the private money you'll ever need to fund your passive cash flow for life empire, using my secret NA strategy

✅ My COMPLETE Buy BIG or Buy SMALL Apartment Method that took over 11 years in the trenches to master

✅ How to systematize your business and turn it into a well-oiled machine, so you only work 15 hours a week or less, and still make a fortune in real estate

Meet the Experts Who’ve Been There

Nicheole Amundsen

Nicheole Amundsen has been actively investing in residential and commercial real estate for over 25 years. She began her real estate career with rehabbing single family homes more than 25 years ago. She continues to hold her first single family rental home portfolio and since then has grown, now a multimillion dollar portfolio, to include more residential homes, apartment buildings, manufactured housing communities, and self-storage units in ten different states.

Nicheole is the owner of two commercial real estate companies, two property management companies, a commercial real estate education company, a note business, and several franchises. She also teaches commercial real estate investing through an apprenticeship program.

James Rey

James Rey provides over 20 years of leadership and entrepreneurial experience to the team. His background includes successful start-ups in the television production, restaurant, and management consulting markets. James has also been a key member in establishing and running the Washington field office for the Stephen Covey Leadership Foundation.

After a brief stint working overseas in Geneva, Switzerland, James returned to the United States and went into the executive search industry, acting as a management consultant for Fortune 100 companies setting up talent acquisition systems and processes.

Today, James is a successful real estate business owner with a multi-million dollar commercial and residential portfolio covering emerging markets in the Mid-Atlantic, South-East, and South Central United States.

Meet the Experts Who’ve Been There

Nicheole Amundsen

Nicheole Amundsen has been actively investing in residential and commercial real estate for over 25 years. She began her real estate career with rehabbing single family homes more than 25 years ago. She continues to hold her first single family rental home portfolio and since then has grown, now a multimillion dollar portfolio, to include more residential homes, apartment buildings, manufactured housing communities, and self-storage units in ten different states.

Nicheole is the owner of two commercial real estate companies, two property management companies, a commercial real estate education company, a note business, and several franchises. She also teaches commercial real estate investing through an apprenticeship program.

James Rey

James Rey provides over 20 years of leadership and entrepreneurial experience to the team. His background includes successful start-ups in the television production, restaurant, and management consulting markets. James has also been a key member in establishing and running the Washington field office for the Stephen Covey Leadership Foundation.

After a brief stint working overseas in Geneva, Switzerland, James returned to the United States and went into the executive search industry, acting as a management consultant for Fortune 100 companies setting up talent acquisition systems and processes.

Today, James is a successful real estate business owner with a multi-million dollar commercial and residential portfolio covering emerging markets in the Mid-Atlantic, South-East, and South Central United States.

SIGN UP TODAY AND ENJOY THESE BONUSES!

Monthly live coaching calls with our REI experts for

6 months

Get all your questions answered live. Be on the cutting edge of multifamily real estate investing. Let us help you customize your growth to your specific market and goals. Replays available.

One-of-a-kind multifamily due diligence checklist

Buy right! Use my 25 years of experience successfully buying thousands of doors across 11 states, in an easy to follow 26 page due diligence checklist. Use my experience to guide you.

How to analyze deals properly

Get access to our spreadsheets, including our custom underwriting spreadsheet based on successfully analyzing and purchasing multiple hundreds of buildings, mobile homeparks and self-storage units, of all sizes across the country.

Amazing multifamily email support from our 7-day-a-week helpdesk

Never be confused as what you need todo to succeed again. We have the answers you seek, and always easily accessible.

Members-Only Private Online Community

Share in feedback and best practices from like-minded members of our private community. Find possible investors and future partners, all online.

Private Passive Cash Flow For Life Document Vault

All the documents you need to hit the ground running. LOI templates, contracts, screening questions to identify the best property management companies, marketing documents, how to raise money successfully and much, much, more.

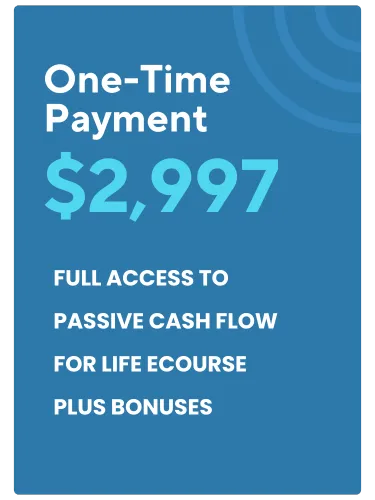

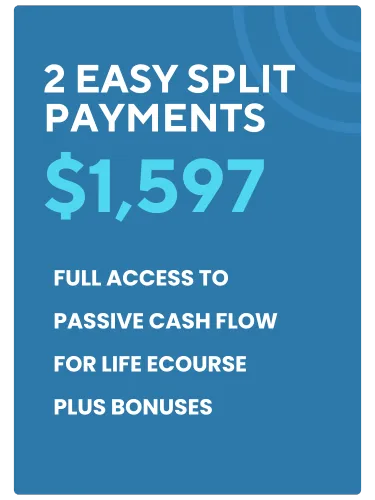

CHOOSE YOUR PATH BELOW

Your Path to Financial Freedom Starts Here

Join Nicheole Amundsen and our dedicated real estate community on a journey that will transform your approach to commercial real estate. The path to growth, expert knowledge, and financial freedom is within reach—don’t let another year slip by. Life is short. Seize the opportunity to unlock proven strategies for success and take your first step toward achieving lifelong financial independence and real estate goals.

TESTIMONIALS

WHAT OUR STUDENTS SAY

Sam Henry

I want to commend you all on a phenomenal event this past weekend! This was exactly what I was looking for. As Gigi may have mentioned in the past, the two of us attended an apartment investing bootcamp last year in New York and your course was definitely a step above. The wealth of material you all covered over these two days filled in the gaps that the other course left out. Armed with your manual as a reference, I feel much more confident and prepared to take on a commercial deal.

Alex Goumilevski

I can highly recommend James and Nicheole in terms of their education and support in helping people grow in their multifamily and commercial investing careers. They are the real deal and about helping people grow and succeed. Before I took their courses, I only invested in single family, and they helped me take the leap into multifamily. Since then, we purchased about 40 multifamily units, have 14 under contract, and are exploring the possibilities of building from ground up.

Emma Tavis Howard

This was a really great class. You get a lot of bang for your buck. If you did not attend, you missed out on a lot. It was wonderful. She took time out to answer questions the whole way through. I’m ready to start analyzing deals and start putting some offers in. I highly recommend the class. Nicheole was fantastic. I can’t speak highly enough on the value you get for your money.

Karri Lamb

I was very pleased with the multifamily class and the knowledge I gained. The class greatly accelerated my learning curve. I was able to apply the knowledge I got from the class to purchase a mobile home park. In addition, I am now using the knowledge to invest passively in apartment complexes as a limited partner. If you are ready to move ahead with multifamily investing, I highly recommend this class.

Sign up for the Passive Cash Flow For Life newsletter to get FREE multifamily investing tips, strategies, and training delivered straight to your inbox!

Frequently Asked Questions

Is Passive Cash Flow For Life only available to licensed real estate agents?

Nope. While having a license can be beneficial to your real estate investing career, you don’t necessarily need one if you want to be a real estate investor. There are in fact no licensing requirements at the state or national level for people who invest in real estate.

Do I need real estate experience to thrive in multifamily investing using the system taught in Passive Cash Flow For Life?

Real estate experience is not necessary. Our modules are laid in logical segments, so you don’t become overwhelmed. When I entered real estate investing, I had NO experience. A lot of people who’ve come through the Passive Cash Flow For Life system have had no experience and went on to become successful investors.

How long does it take to complete the program?

Passive Cash Flow For Life is self-paced. You are not required to complete it in any certain amount of time. You may work as fast as you like - we won't hold you back. The faster you go and more work you do, the faster you’ll start receiving passive cash flow for life.

How long do I have access to the program?

How does lifetime access sound? If you join and pay in full today (or once you complete your payment plan), you'll have unlimited access to Passive Cash Flow For Life for as long as you like - across any and all devices you own.

How often (and how long) are the monthly coaching calls? Are they recorded?

We hold a monthly coaching call that is scheduled for 1 hour. However, your coaches will go as long as needed to answer all your questions on every call. The calls will be recorded and uploaded to the members’ area.

What kind of support is there in addition to the coaching calls?

You can also email us at [email protected]. We also have an exclusive Facebook group where you can ask questions.

Your Wealth-Building Journey Starts Now—

Don’t Wait!

You deserve a future of financial freedom—get started today and make it happen!

©2026 – Passive Cash Flow For Life | All Right Reserved

Contact Us